Rocks on Rapa Nui tell the story of a small, resilient population − countering the notion of a doomed overpopulated island

Conventional wisdom holds that the island of Rapa Nui, also known as Easter Island, once had a large population that crashed after living beyond its means and stripping the island of resources. A new research study[1] my colleagues and I conducted has struck another blow to this notion by using artificial intelligence to analyze satellite...

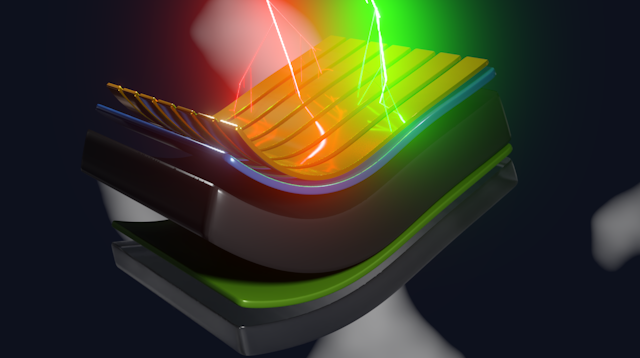

Space radiation can damage satellites − my team discovered that a next-generation material could self-heal when exposed to cosmic rays

The space environment is harsh and full of extreme radiation[1]. Scientists designing spacecraft and satellites need materials that can withstand these conditions.

In a paper published in January 2024[2], my team[3] of materials researchers demonstrated that a next-generation semiconductor material[4] called metal-halide perovskite[5] can actually ...

Boost your immune system with this centuries-old health hack: Vaccines

There are a dizzying number of tips, hacks and recommendations[1] on how to stay healthy, from dietary supplements[2] to what color of clothes[3] promotes optimal wellness. Some of these tips are helpful and based on good evidence, while others are not.

However, one of the easiest, most effective and safest ways to stay healthy is rarely...